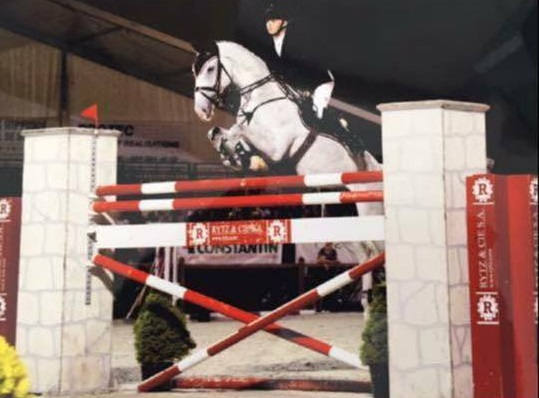

Javiera Bonelli

Javiera Bonelli - Argentina - Endurance Rider / Horses competed by Javiera Bonelli include Corazon Partido & Ls Eclipse

ContentAdvert

ContentAdvert

The Buying Process

Rule #1 Don`t let the Buying Process Scare You. Realtors are trained to help.

Rule # 2 Get Representation - You need someone on your side

Rule # 3 Get educated. Ask lots of questions about the property and the area.

Rule # 4 No matter what your financial strength, get pre-approved for financing so that last-minute problems won`t interfere with your purchase.

Follow these steps with the help of your agent:

∑ Have a counseling session with your agent to map out a game plan

∑ Discuss communication and the follow up systems you will be using

∑ See a lender to get your financing in place

∑ Review all the documentation required for the transaction

∑ Find a property

∑ Negotiate the transaction, including all contingencies and conditions

∑ Use the inspection period to investigate any issues of concern

∑ Have a Home Inspection completed

∑ Negotiate repairs

∑ Investigate disclosure issues (SPDS, termite, lead based paint, pool rules, etc.)

∑ Arrange for and have repairs completed

∑ Make sure you get an appraisal

∑ Meet with your Escrow Company to arrange the closing

∑ Line up the funds for the closing

∑ Arrange your electricity, phone, water, mail service and insurance

∑ Close, record and move in

The importance of communication is critical. This is a group effort. You and your agent must work together to co-ordinate all the details. Remember, you are in this together.

GLOSSARY OF REAL ESTATE TERMS

Appraisal - An opinion of value based upon of factual analysis

Appraisal Methods - Generally, there are three major methods - Cost approach, Income approach, Market Value (comparables) approach.

Appreciation - An increase in value of real estate.

Assumption of Mortgage - The taking of title to property by a grantee, wherein he or she assumes liability for payment of an existing note secured by a mortgage or deed of trust against the property: becoming a co-guarantor for the payment of a mortgage or deed of trust not.

Closing - The final settlement of real estate transaction between buyer and seller.

Condominium - A structure of individual fee ownership of units combined with joint ownership of common area of the structure and the land.

Contract for Deed - A contract ordinarily used in connection with the sale of property in cases when the seller does not wish to convey title until all or the buyer pays a certain part of the purchase price.

Contract of Title - A summary or digest of the conveyances, transfers, and any other facts relied on as evidence of title, together with any other elements of record, which may affect the marketability of the title.

Conventional Loan - A mortgage securing a loan made by investors without governmental underwriting, i.e., which is not FHA insured or VA guaranteed.

Counter Offer - A rejection of an offer by a seller along with an agreement to sell the property to the potential buyer on terms differing from the original offer.

Deed - Written instrument which, when properly executed and delivered, conveys title.

Discount Points - Additional charges made by a lender at the time a loan is made. Points are measured as a percent of the loan, with each point equal to one percent.

Earnest Money Deposit - Down payment made by a purchaser as evidence of good faith.

Easement - Created by grant or agreement for a specific purpose, or easement is the right, privilege or interest which one party has in the land of another. Example: right of way.

Equity - The interest or value which an owner has in real estate over and above the liens against the real property.

Escrow - The deposit of instruments and funds with instructions to a third neutral party (Escrow Agent) to carry out the provision of an agreement or contract: when everything is deposited to enable carrying out the instructions, it is called a complete or perfect escrow.

F.H.A. Loan - (federal Housing Administration) - A loan which has been insured by the federal government guaranteeing its payment in case of default by the owner.

FMHA Loan - A loan by the federal government similar to FHA loan usually used for residential property in rural areas.

Impound Account - Account held by the lender for payment of taxes, insurance, or other periodic debts against real property.

Joint Tenancy - Joint ownership by two or more persons with right of survivorship; all joint tenants own equal interest and have equal rights in the property.

Lien - A form of encumbrance which usually makes property security for the payment of a debt of discharge of an obligation. Example: Judgments, taxes, mortgages, deeds of trust, etc.

Marketable Title - Merchantable title; title free and clear of objectionable liens or encumbrances.

Mortgage - An instrument recognized by law by which property is hypothecated to secure the payment of a debt or obligation: procedure for foreclosure in event of default is established by state.

Mortgage Insurance - Insurance written by an independent mortgage insurance company protecting the mortgage lender against loss incurred by a mortgage default, thus enabling the lender to lend a higher percentage on the sale price.

Origination Fee - A fee charged by the lending institution.

Personal Property - Any property which is not real property, e.g., money, savings accounts, appliances, cars, boats, etc.

Purchase Agreement - An agreement between a buyer and seller for the purchase of real estate.

Quitclaim Deed - A deed operating as a release.

Real Property - Land and whatever by nature or artificial annexation is a part of it.

Special Assessment - Legal charge against real estate by a public authority to pay cost of public improvements such as: street lights, sidewalks, street improvements, etc.

Sub-Division - A parcel of land that has been divided into smaller parts.

Term of Mortgage - The period during which a mortgage must be paid.

Trust Account - An account separate and apart and physically segregated from broker`s own faults, in which is required by law to deposit all funds collected for clients.

V.A. Loan - A loan guaranteed by the Veterans Administration.

Warranty Deed - A deed used to convey real property which contains warranties of title and quiet possession, and the grantor agrees to defend the premises against the lawful claims of third persons.

1031 Exchange - Also referred to as a "nontaxable sale", is a method enabling property owners to trade an investment property for another investment property (or properties) without paying capital gain taxes on the transaction.

ContentAdvert

ContentAdvert

The Buying Process

Rule #1 Don`t let the Buying Process Scare You. Realtors are trained to help.

Rule # 2 Get Representation - You need someone on your side

Rule # 3 Get educated. Ask lots of questions about the property and the area.

Rule # 4 No matter what your financial strength, get pre-approved for financing so that last-minute problems won`t interfere with your purchase.

Follow these steps with the help of your agent:

∑ Have a counseling session with your agent to map out a game plan

∑ Discuss communication and the follow up systems you will be using

∑ See a lender to get your financing in place

∑ Review all the documentation required for the transaction

∑ Find a property

∑ Negotiate the transaction, including all contingencies and conditions

∑ Use the inspection period to investigate any issues of concern

∑ Have a Home Inspection completed

∑ Negotiate repairs

∑ Investigate disclosure issues (SPDS, termite, lead based paint, pool rules, etc.)

∑ Arrange for and have repairs completed

∑ Make sure you get an appraisal

∑ Meet with your Escrow Company to arrange the closing

∑ Line up the funds for the closing

∑ Arrange your electricity, phone, water, mail service and insurance

∑ Close, record and move in

The importance of communication is critical. This is a group effort. You and your agent must work together to co-ordinate all the details. Remember, you are in this together.

GLOSSARY OF REAL ESTATE TERMS

Appraisal - An opinion of value based upon of factual analysis

Appraisal Methods - Generally, there are three major methods - Cost approach, Income approach, Market Value (comparables) approach.

Appreciation - An increase in value of real estate.

Assumption of Mortgage - The taking of title to property by a grantee, wherein he or she assumes liability for payment of an existing note secured by a mortgage or deed of trust against the property: becoming a co-guarantor for the payment of a mortgage or deed of trust not.

Closing - The final settlement of real estate transaction between buyer and seller.

Condominium - A structure of individual fee ownership of units combined with joint ownership of common area of the structure and the land.

Contract for Deed - A contract ordinarily used in connection with the sale of property in cases when the seller does not wish to convey title until all or the buyer pays a certain part of the purchase price.

Contract of Title - A summary or digest of the conveyances, transfers, and any other facts relied on as evidence of title, together with any other elements of record, which may affect the marketability of the title.

Conventional Loan - A mortgage securing a loan made by investors without governmental underwriting, i.e., which is not FHA insured or VA guaranteed.

Counter Offer - A rejection of an offer by a seller along with an agreement to sell the property to the potential buyer on terms differing from the original offer.

Deed - Written instrument which, when properly executed and delivered, conveys title.

Discount Points - Additional charges made by a lender at the time a loan is made. Points are measured as a percent of the loan, with each point equal to one percent.

Earnest Money Deposit - Down payment made by a purchaser as evidence of good faith.

Easement - Created by grant or agreement for a specific purpose, or easement is the right, privilege or interest which one party has in the land of another. Example: right of way.

Equity - The interest or value which an owner has in real estate over and above the liens against the real property.

Escrow - The deposit of instruments and funds with instructions to a third neutral party (Escrow Agent) to carry out the provision of an agreement or contract: when everything is deposited to enable carrying out the instructions, it is called a complete or perfect escrow.

F.H.A. Loan - (federal Housing Administration) - A loan which has been insured by the federal government guaranteeing its payment in case of default by the owner.

FMHA Loan - A loan by the federal government similar to FHA loan usually used for residential property in rural areas.

Impound Account - Account held by the lender for payment of taxes, insurance, or other periodic debts against real property.

Joint Tenancy - Joint ownership by two or more persons with right of survivorship; all joint tenants own equal interest and have equal rights in the property.

Lien - A form of encumbrance which usually makes property security for the payment of a debt of discharge of an obligation. Example: Judgments, taxes, mortgages, deeds of trust, etc.

Marketable Title - Merchantable title; title free and clear of objectionable liens or encumbrances.

Mortgage - An instrument recognized by law by which property is hypothecated to secure the payment of a debt or obligation: procedure for foreclosure in event of default is established by state.

Mortgage Insurance - Insurance written by an independent mortgage insurance company protecting the mortgage lender against loss incurred by a mortgage default, thus enabling the lender to lend a higher percentage on the sale price.

Origination Fee - A fee charged by the lending institution.

Personal Property - Any property which is not real property, e.g., money, savings accounts, appliances, cars, boats, etc.

Purchase Agreement - An agreement between a buyer and seller for the purchase of real estate.

Quitclaim Deed - A deed operating as a release.

Real Property - Land and whatever by nature or artificial annexation is a part of it.

Special Assessment - Legal charge against real estate by a public authority to pay cost of public improvements such as: street lights, sidewalks, street improvements, etc.

Sub-Division - A parcel of land that has been divided into smaller parts.

Term of Mortgage - The period during which a mortgage must be paid.

Trust Account - An account separate and apart and physically segregated from broker`s own faults, in which is required by law to deposit all funds collected for clients.

V.A. Loan - A loan guaranteed by the Veterans Administration.

Warranty Deed - A deed used to convey real property which contains warranties of title and quiet possession, and the grantor agrees to defend the premises against the lawful claims of third persons.

1031 Exchange - Also referred to as a "nontaxable sale", is a method enabling property owners to trade an investment property for another investment property (or properties) without paying capital gain taxes on the transaction.